Texas Medicare Part D Coverage

If you have Medicare Part D, you will be able to get coverage for the cost of your prescription medications. This can help you save money on the cost of your medications, which can be expensive without insurance. Some Texas Medicare Part D plans also provide coverage for other medical services, such as vaccines or medical supplies.

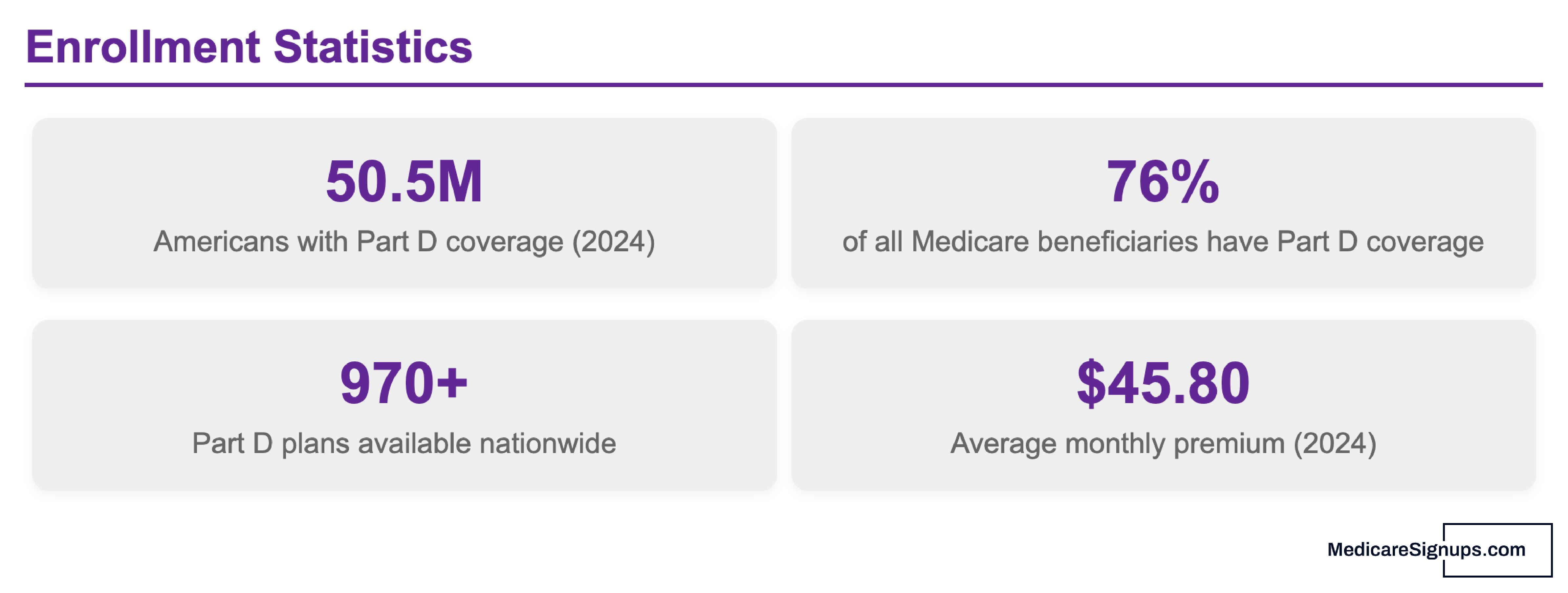

To enroll in Medicare Part D, you must first be enrolled in Medicare Part A and/or Part B. You can then choose a Medicare Part D plan from a private insurance company that offers this type of coverage. You will pay a monthly premium for your Medicare Part D plan, and in TX, you may also have to pay a deductible and copayments for your medications.

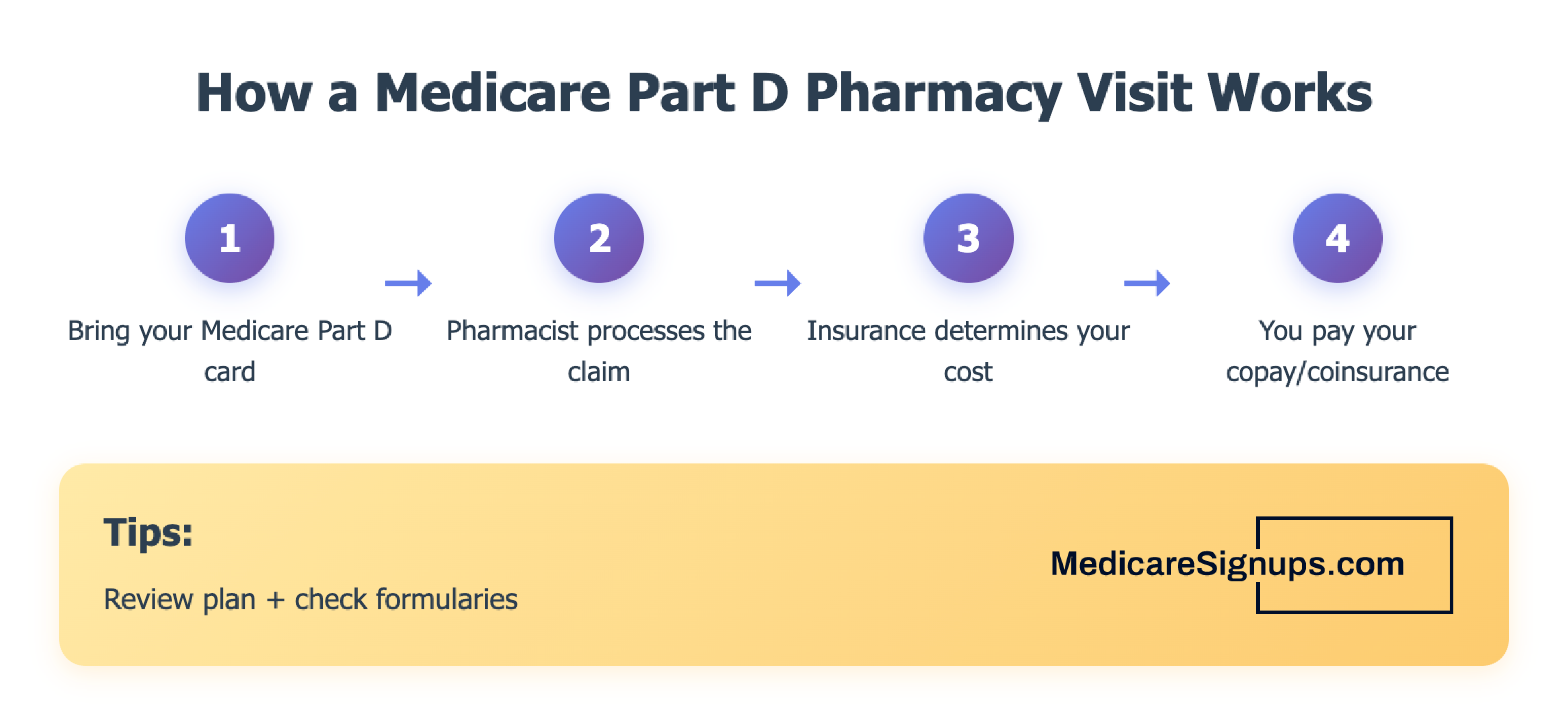

Pharmacy Visits with Medicare Part D

When you go to the pharmacy to fill a prescription, you will need to show your Medicare Part D insurance card. The pharmacist will then use this card to process your claim and determine what portion of the cost will be covered by your insurance plan.

It's important to note that not all prescription medications are covered by Medicare Part D. Some drugs, such as weight loss medications or drugs used to treat erectile dysfunction, may not be covered. You can check with your insurance company, Medicare plan, or Medicare Agent to see what medications are covered under your plan.

If you have Medicare Part D, it's important to review your plan periodically to make sure you are getting the best coverage for your needs. You can also compare different plans to see if there is one that offers better coverage for the medications you take.

Overall, Medicare Part D can provide valuable coverage for the cost of your prescription medications. If you have Medicare and live in Texas, it's worth considering enrolling in a Medicare Part D plan to help you save money on the cost of your medications.