Who is eligible for Medicare in Texas?

You must be either a U.S. citizen, permanent legal resident or have lived in the United States for at least five consecutive years to be eligible for Medicare Part A or Part B in the state of Texas. You must be 65 years old or older in most cases. If you are disabled, you may qualify for Medicare prior to age 65.

You are generally eligible for Original Medicare Parts A and B if you are a U.S citizen or have been a legal permanent residence for at least five continuous years. If you meet one of these criteria, you will be eligible for Medicare in Texas:

- You are 65 years old or older

- You are under 65 and permanently disabled.

- Have End-stage renal disease (ESRD).

- Have Lou Gehrig's Disease is also known as ALS (Amyotrophic Lateral Sclerosis).

A person who has been receiving monthly Social Security benefits or Railroad Retirement Board (RRB) benefits for at least four months before turning 65 does not have to file separate applications to be eligible to premium-free Part A. The individual in Texas will automatically receive Part A at 65 in this instance.

Individuals who are not receiving RRB or Social Security benefits monthly must apply for Medicare. Contact the Social Security Administration to file an application.

Part A coverage starts the month an individual turns 65. However, he/she must file an application for Part A or for Social Security benefits or RRB benefits within six months after he/she turns 65. Part A coverage will not be effective if the application is filed after 6 months.

An individual who turns 65 on the first of each month will have Part A coverage. This applies to the person whose 65th birthday falls on the first of the following months. If an individual's 65th birthday falls on December 1, Part A coverage begins on November 1.

In Texas, Am I Automatically Eligible for Medicare When I Turn 65?

Yes, unless you actively decline Medicare Part B coverage because you’re still working and receiving employer-based healthcare benefits. When you turn 65, most people are eligible for Original Medicare (Parts A and B). If you’re still working and have employer-based health insurance, you can defer Medicare until you stop working and come off of your employer’s health insurance plan.

Who Is Not Eligible for Medicare in TX?

Individuals who don't meet the above requirements, such as being eligible for Social Security and Railroad Retirement Board (RRB) benefits, will not be considered.

An individual must have Medicare coverage based on either their earnings or the earnings of a spouse, parent or child to be eligible for premium-free Part A. For premium-free Part B, the worker must have a set number of quarters (QCs) and apply for Social Security or Railroad Retirement Board benefits. The number of QCs needed depends on whether the individual is applying for Part A based on age, disability, or End Stage Renal Disease. During a person's working years, QCs can be earned by paying payroll taxes under Federal Insurance Contributions Acts (FICA). The majority of individuals pay full FICA taxes so that the QCs earned can be used to satisfy the requirements for monthly Social Security benefits as well as premium-free Part B.

Individuals in Texas who are eligible for premium-free Part A can enroll at any time, even if they are not automatically enrolled.

Medicare Enrollment Windows

Individuals who wish to enroll in premium Part A, B, or both may not enroll during the enrollment periods set out by law which applies in Texas. These enrollment periods are applicable to premium Part A as well as Part B.

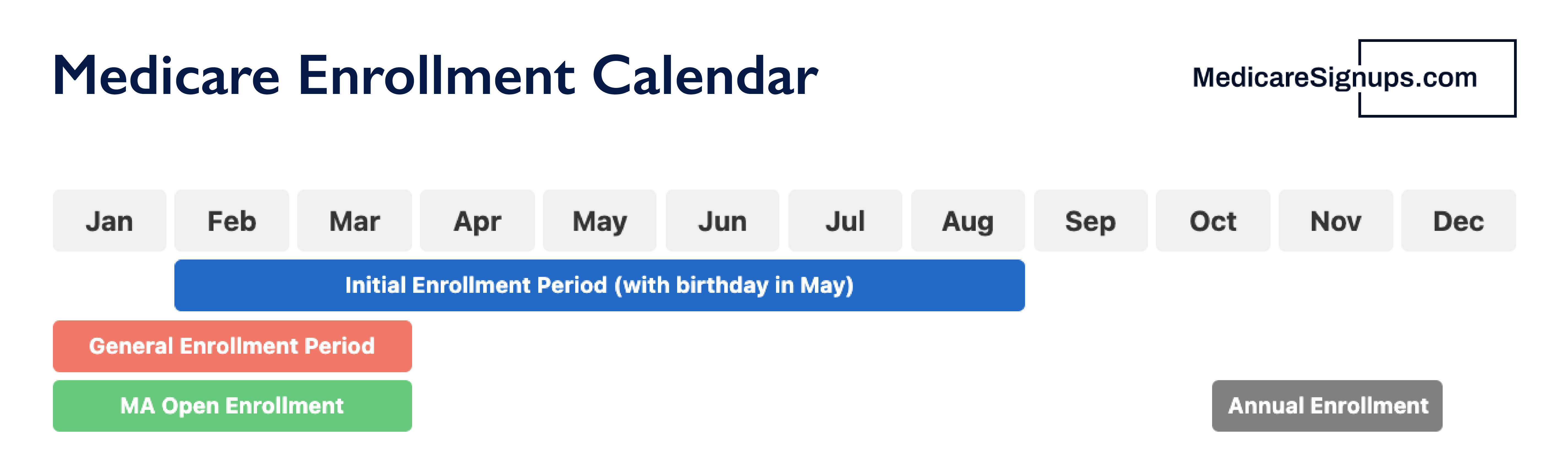

- Initial Enrollment Period

- General Enrollment Period

- Special enrollment Periods

Texas Initial Enrollment Period (IEP)

The IEP is a period of 7 months that starts 3 months before a person turns 65. It ends 3 months later. A person under 65 years old who is entitled to Medicare due to disability begins with the 25th month in disability benefit entitlement. The IEP for these people begins three months prior to the 25th months of disability benefit entitlement. It also includes the 25th month and ends three months later. Individuals with ESRD or ALS have a different IEP. It depends on the individual's situation.

The month following a person's IEP enrollment, coverage will start. After receiving disability benefits from Social Security, a disabled person is automatically enrolled in Medicare Part A or Part B.

Most people will be charged a late enrollment penalty if they do not enroll in Part A or Part B when they are first eligible. For as long as the person holds Part B, the Part B penalty will be assessed.

Texas General Enrollment Period (GEP)

GEP is a three-month period that runs from January 1 to March 31 each year. The month following an individual's enrollment during the GEP will see Part A and Part B coverage.

Texas Special Enrollment Periods (SEP)

You can sign up for Part A (or Premium Part A) in certain circumstances without having to pay a late enrollment penalty. The Special Enrollment Period is available only for a short time. If the person does not sign up during the Special Enrollment Period they will have to wait until the next General Enrollment period and may have to pay a monthly late enrollment penalty.

The month following a person's enrollment during their SEP, coverage will start.

SEP to the Working Aged or Working Disabled in TX

Individuals in Texas who are not eligible for Part B or premium part A because they were covered by a group plan based on their current employment or that of a spouse (or that of a family member if disabled) can enroll during this SEP.

An individual can sign up at any time during current employment or the 8-month period beginning with the month that ends in which the group's coverage ends.

This SEP is not available to individuals with ESRD.