The Value of Local Agents in Navigating Medicare Coverage in Texas

Understanding the Role of Local Medicare Insurance Professionals in Texas

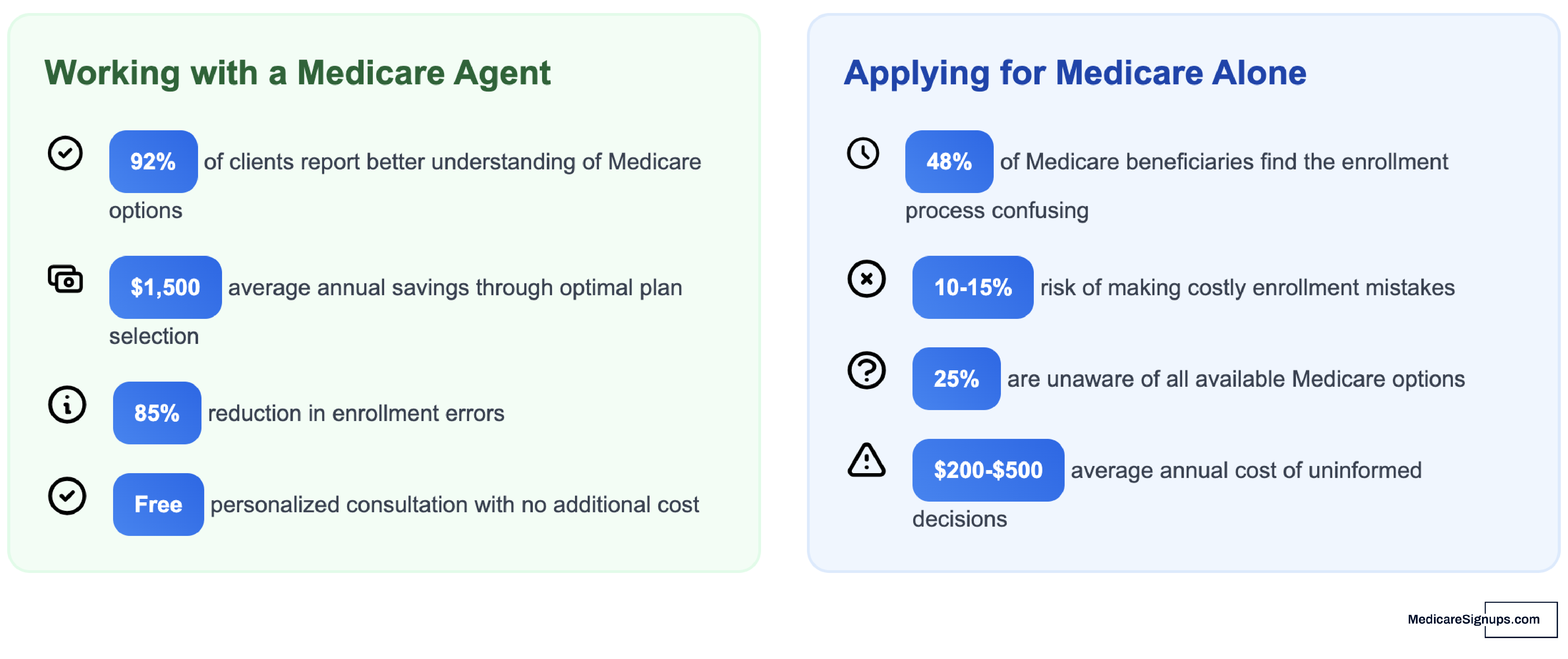

Local agents and brokers in Texas possess a deep understanding of the strengths and weaknesses of many available plan options and have extensive knowledge about healthcare providers in the community. A responsible, licensed, and certified, LOCAL insurance professional is well-versed in the complexities of Medicare and health care coverage specific to TX. They play a pivotal role in assisting people to make better health plan choices, providing ongoing support to help resolve issues, and managing coverage as needs change in Texas. These professionals serve as staunch advocates for their clients, all without any additional cost beyond the plan premium.

Why Choose a Local Medicare Agent or Broker in Texas?

Choosing a local insurance agent or broker in Texas (TX) brings a multitude of benefits. Their advice and support can be invaluable, especially for individuals transitioning from employer-based coverage, retiring, turning 65, or those who are already Medicare eligible. Here are some key reasons why engaging with a local insurance expert in Texas is beneficial:

- Personalized Advice: Local agents offer tailored advice that addresses your specific health care needs and circumstances in Texas. They take the time to understand your situation, providing recommendations that align with your health and financial objectives within the context of TX.

- Expertise in Local Healthcare Landscape: With their finger on the pulse of the Texas healthcare system, these agents can guide you to the best plans that include your preferred doctors and healthcare facilities, ensuring you receive the highest quality care available in TX.

- Ongoing Support and Advocacy: Beyond the initial enrollment local agents in Texas provide continued support, helping you navigate any issues that arise and advocating on your behalf. Whether it's dealing with claims, understanding benefits, or updating coverage to match changing needs, they are always ready to assist in TX.

- Cost-Effective Solutions: Because they understand the intricacies of various plans and how they match different needs in Texas, local agents can help you find the most cost-effective healthcare solutions. Their expertise can save you from unnecessary expenses, making sure you get the best value for your premium in TX.

How to Find the Right Local Insurance Professional in Texas

Finding the right local insurance agent or broker in Texas requires some research and due diligence. Here are steps to guide you in your search:

- Use a Free Directory: Websites like Medicare Agents Hub allow you to find a local Texas-licensed Medicare agent or broker who you can meet with face-to-face or over the phone.

- Ask for Recommendations: Start by asking friends, family, and healthcare providers in Texas for recommendations. Personal referrals can lead you to trustworthy professionals who have proven their value in TX.

- Check Credentials: Ensure any agent or broker you consider in Texas is licensed and certified to offer advice on Medicare and health insurance plans. Their qualifications are a testament to their knowledge and expertise in TX.

- Interview Potential Agents: Before making a decision, meet with potential agents in Texas. This gives you a chance to discuss your needs and assess whether they're a good fit for you. Pay attention to their willingness to listen, explain complex information clearly, and provide personalized advice relevant to TX.

- Evaluate Their Network: Consider agents with a strong network of healthcare providers and insurance companies in Texas. This diversity ensures they can offer a wide range of options and find the best coverage for you in TX.

Conclusion

Choosing the right health care coverage is a critical decision that can significantly impact your well-being and financial health. Local insurance agents and brokers offer invaluable guidance, personalized support, and advocacy to help you navigate the complexities of Medicare and health insurance. By partnering with a knowledgeable and responsible local professional, you can ensure that your health care coverage meets your needs today and adjusts seamlessly as those needs evolve. Remember, the right agent is not just a consultant but a lifelong ally in managing your health care journey.