Common Medicare Mistakes First-Time Enrollees in Texas Make

Enrolling in Medicare for the first time can feel confusing fast. There are parts, plans, deadlines, and fine print that no one really explains until you are already in it. Many people assume Medicare works like employer insurance, or that once you sign up you are done forever. That assumption alone leads to some of the most common and costly mistakes.

If you are new to Medicare or approaching enrollment, learning what not to do can save you money, stress, and a lot of frustration later.

Waiting Too Long to Enroll

One of the biggest mistakes people make is missing their enrollment window. Your Initial Enrollment Period starts three months before the month you turn 65, includes your birthday month, and ends three months after.

If you delay enrolling in Medicare Part B without having qualifying employer coverage in Texas, you could face a late enrollment penalty that lasts for life. The same goes for Medicare Part D drug coverage. These penalties are added to your monthly premium and do not go away.

Many people delay because they feel healthy or assume they can sign up later with no consequences. Medicare does not work that way.

Assuming Medicare Covers Everything

Medicare is good coverage, but it does not cover everything. Many first-time enrollees assume routine dental, vision, hearing aids, or long-term care are included. Original Medicare generally does not cover these services.

This can be a shock when someone needs dentures, glasses, or hearing aids and realizes they are paying out of pocket. Understanding what Medicare does and does not cover ahead of time helps you plan and avoid surprises.

Choosing a Plan Based Only on the Monthly Premium

A low monthly premium can be tempting, especially if you are on a fixed income. But choosing a Medicare plan based only on price is a common mistake.

Plans with low premiums may come with higher copays, limited networks, or higher costs for hospital stays and prescriptions. Over the course of a year, a plan that looked cheap on paper can end up costing much more than expected.

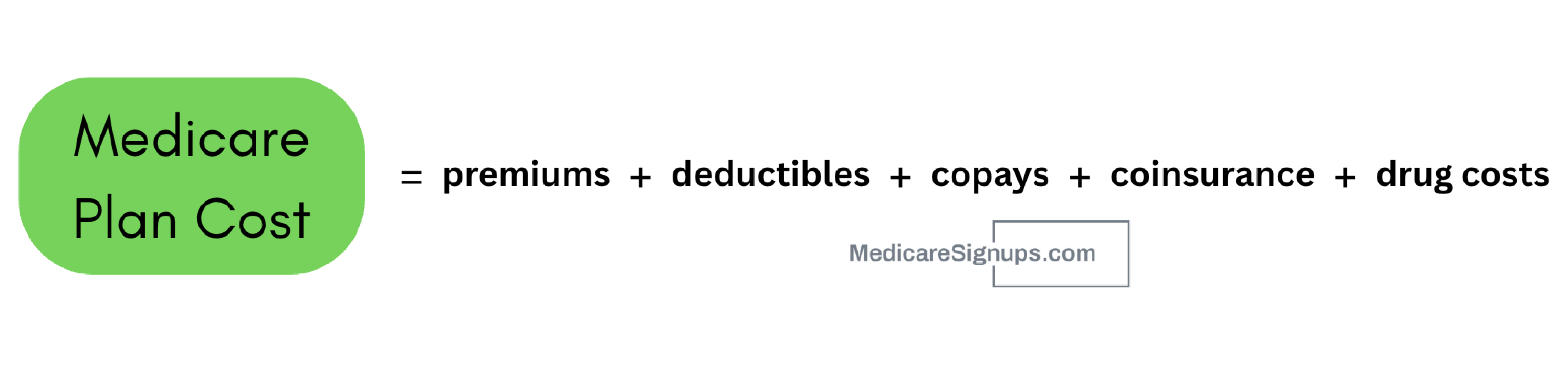

The real cost of a Medicare plan includes premiums, deductibles, copays, coinsurance, and drug costs combined.

Not Checking Prescription Drug Coverage Carefully

Prescription drugs are one area where small details matter a lot. Medicare drug plans can vary widely in how they cover medications.

Some plans may not cover a specific drug at all. Others may cover it but place it on a higher tier with higher costs. Formularies can also change each year.

Many first-time enrollees assume all Part D plans are similar. They are not. Failing to check how your medications are covered can lead to higher costs or the need to switch plans later.

Ignoring Provider Networks

This mistake shows up most often with Medicare Advantage plans in Texas. These plans often use networks of doctors, hospitals, and specialists.

If your doctor or hospital is not in the network, your costs may be much higher or the care may not be covered at all. Some people enroll first and check providers later, only to realize their preferred doctor is out of network.

Before choosing a Medicare plan in Texas, it is important to confirm that your doctors, specialists, and hospitals are included.

Skipping Coverage Because You Feel Healthy

Feeling healthy today does not guarantee you will feel the same way next year. Many first-time enrollees skip certain coverage options because they think they will not need them.

Health can change quickly. Injuries, diagnoses, or unexpected hospital visits happen more often as we age. Choosing coverage based only on how you feel right now can leave you exposed later.

Medicare planning works best when you consider not just current health, but possible future needs as well.

Thinking Medicare Is Set It and Forget It

Another common misconception is that once you choose a Medicare plan, you are locked in forever. Medicare plans can and do change every year.

Premiums, benefits, networks, and drug coverage can all shift. That is why Medicare has an Annual Enrollment Period each fall. This gives Texas beneficiaries the chance to review and change their coverage if needed.

People who never review their plan often end up paying more than necessary or losing coverage they relied on.

Not Asking Questions Early Enough

Medicare rules are not intuitive, and many mistakes happen simply because people do not ask questions soon enough. Waiting until the last minute limits your options and increases stress.

Learning about Medicare early gives you time to compare plans, understand costs, and avoid penalties. It also helps you feel more confident instead of rushed.

Final Thoughts

Medicare is not impossible to understand, but it does require attention. Most mistakes first-time enrollees make are not about being careless. They happen because Medicare is complex and people are not given clear guidance upfront.

By enrolling on time, understanding what is covered, reviewing plans carefully, and staying engaged each year, you can avoid the most common pitfalls of a Texas Medciare beneficiary. A little preparation goes a long way toward making Medicare work the way it should for you.